What is No Claim Discount? How does it help you to save money on motor insurance/motor takaful coverage?

No Claim Discount (commonly abbreviated to NCD) is a type of motor insurance discount given to you:

- for not making any insurance claim (being a safe driver) in the past 12 months AND

- for not having any insurance claim by third party made against your car insurance policy

No Claim Discount plays a big role in determining how much you have to pay for motor insurance as it offers discount up to 55% of your base motor insurance or motor takaful coverage. 😎

The discount rate is fixed by Persatuan Insurans Am Malaysia (PIAM) Motor Tariff. The longer a claim not made against your own policy, the higher discount you will get. The maximum amount of discount is capped at 55% after five consecutive years of not making any claims.

No Claim Discount (NCD) Rate in Malaysia

| Period of No Claims Made | Private Car | Commercial Vehicle |

|---|---|---|

| First year | 0% | 0% |

| Second year | 25% | 15% |

| Third year | 30% | 20% |

| Fourth year | 38.33% | 25% |

| Fifth year | 45% | 25% |

| After fifth year | 55% | 25 |

As you can see from the table above, significant saving is attained as it is proven that you are becoming a safer, veteran driver.

By driving safely each year and not making any claim against your car insurance policy, this helps reduce accidents on the road, and allow motor insurers to reward you with discounts for your car insurance.

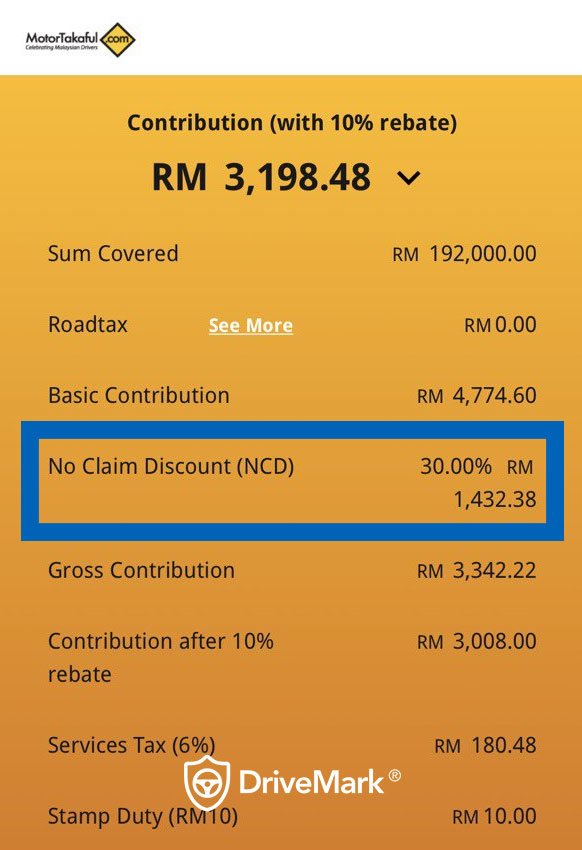

As an example – the insurance quotation for a BMW F30 below offers Basic Contribution of RM4,774.60. With a 30% N0 Claim Discount (NCD) applied, the car owner saves a massive RM1,432.38. If the owner reached 55% NCD, his immediate saving would be RM2,62.03 😍

How do I check my NCD?

You can use this 🚀 free online service by MyCarInfo to check current NCD. Take note that you will need to submit NRIC and vehicle plate number to view this information. The NRIC and Plate number have to match vehicle ownership information stored by Malaysia Road Transport Department (Jabatan Pengangkutan Jalan).

Do not worry about submitting your data in the portal above. MyCarInfo is owned by Insurance Services Malaysia Berhad. Your data is protected.

What happen when I am involved in a car accident?

The most important part is to be calm, document the accident and follow our guide here 7 important car accident tips that you should know.

No Claim Discount is given to vehicle owners that do not make any claim against his own car insurance policy. This means several things:

- If you are innocent/not the cause of the accident: Claim will be made against the party-at-fault. Thus this will not affect your NCD.

- If you are the party-at-fault: Claim by other parties will be made against your car insurance policy. This will affect your NCD. If a claim is made against your policy, current NCD that you have accumulated will be forfeited and reverts to 0%. This will impact next year’s insurance renewal price as you will no longer enjoy significant insurance saving.

There are also situations when your car is damaged in an accident with the following scenario:

- The other party runs away (and you have his car registration number):

- If you manage to catch his registration number, inform the police. Having a dashcam footage will always help.

- If police determines the other party is at fault, you may make an NFOC – No fault Own Damage Claim where your car insurance will pay for car repair. This does not affect your NCD because you are innocent.

- NFOC is also known as ODKFK (Own Damage, Knock for Knock)

- However take note that filing NFOC/ODKFK can only be done under specific circumstances. NFOC does not apply when:

- Third party bodily injury is involved, no matter who is at fault

- The insurer of the other vehicle does not do business in Malaysia (for example, a Singapore/Thai vehicle hit your car in Malaysia).

- The other vehicle is a bus, taxi, limousine or hire & drive vehicle (Grab/Uber etc)

- The other vehicle is not identifiable (ie you do not know with certainty the registration number of the vehicle)

- the other vehicle is not insured

- Filing NFOC/ODKFK is not a straightforward process. Please consult your insurer for more information.

- The other party runs away (and you do not have his car registration number):

- If the other party does not make any police report, you will have to make an Own-Damage claim.

- The claim will be filed against your own policy, which means this will affect your future NCD.

Who decides who is the party-at-fault?

The police will decide who is the party-at-fault in an accident based on his investigation.

Does replacing broken windscreen affects my NCD?

Well the answer depends on circumstances of the windscreen replacement.

- If you already have windscreen insurance add-on: Insurer will pay for the windscreen replacement, BUT this will not affect your NCD because the windscreen is already covered by the windscreen insurance add-on.

- If you do not have windscreen insurance add-on: You can request your insurer to pay for the windscreen but this will affect your NCD because the insurer will consider this as a claim against your main car insurance policy.

- If you pay for windscreen replacement using your own money: This will not affect your NCD.

Follow our detailed and complete 🚀 Guide to Claim and Replace Broken Windscreen for more information about this.

I change to a new motor insurer/motor takaful provider. Do I still enjoy the NCD?

Yes, NCD is attached to you. Thus if you decide to change to a better, more friendlier car insurer/motor takaful provider, you will still enjoy the NCD that you have accumulated in the past.

Changing to a new insurer will not reset your NCD.

I bought a new car. Can I transfer my NCD from the old car to the new one? 😛

Yes, you can.

In fact, this is a ❤️ recommended tip because typically you are paying higher premium for new cars (because of higher vehicle insured value). Thus, transferring NCD from the old car to the new car would be a smart thing to do because you will get higher monetary discount than keeping NCD with the old car.

To transfer the NCD from an old car to the new car, you will need to go to insurer’s branch and request them to transfer NCD. You will have to pay prorated non-NCD value of the old car. That is OK because it will be lower than paying the full insurance price of the new car.

Once the NCD has been transfered, your old car will command 0% NCD. If no claims are made against it, it will have 25% NCD in the next insurance renewal.

Your new car will enjoy whichever NCD value previously enjoyed by the old car.

Both cars will start to accumulate NCD separately in the future.

Frequently asked questions about No Claim Discount in Malaysia

- I am a first time car owner. What is my No Claim Discount (NCD) rate?

All new first time car owners will have an NCD rate of 0%. You will earn higher No Claim Discount as your accumulate more experience and drives better. Refer to the table above to know how much NCD you can get based on years of claim-free driving experience. - My mom has 55% NCD. Can she transfer the NCD to me? 😋

No, NCD is tied to the person. It can not be transferred to other people. - I had a car accident recently. It was not my fault. The police report also says it is not my fault. Will this accident affect my No Claim Accident (NCD) rate?

Motor insurers will rely fully on the police report to determine the party at fault. If the police report indemnify you from being the cause of accident, you are considered as innocent. This means your NCD next year will not be affected. - I had a car accident recently. It was a small accident and I decide to repair the car on my own. Will this affect my NCD?

If you decide to make any repair to the car using your own money, this will not affect NCD. NCD is only affected if there is a claim made against your car insurance policy. - I had a car accident recently. However the other party runs away. I managed to get the vehicle registration number of the other vehicle. Will this accident affect my No Claim Discount (NCD) rate?

You will need to make a police report about the accident. The police will make an investigation and cross reference any other police report. If the other vehicle made a police report too, the investigating officers will interview the parties involved to determine party-at-fault. The outcome of the investigation will determine whether your No Claim Discount (NCD) is affected, or remain untouched. - I had a car accident recently. However the other party runs away before I could catch the vehicle registration number. Now I have to submit motor insurance claim to my insurer. Will this accident affect my No Claim Discount (NCD) rate?

As always, you will need to make a police report about the car accident and the hit-and-run incident. Luckily you can file for No-Fault Own Damage claim (NFOC). Being an innocent driver, your insurer will cover the cost of repair without affecting your NCD. 😍 Awesome isn’t it?

This is why you should renew motor insurance or motor takaful with reputable insurers/takaful providers in Malaysia.

To make a No-Fault Own Damage claim (NFOC), please follow this article on 🚀 how to file car insurance claim when other vehicle hits your parked car.

Similar Articles

Car Accident Detection and Emergency Alert using DriveMark mobile app

When DriveMark was launched back in 2017, it carried our aspiration to make the roads safer for everyone. From then on, we introduced several features to encourage drivers to be...

#ShareStreakLah Challenge!

You want more rewards. We hear you 😏 Introducing…… #ShareStreakLah Challenge! This time, we want to see if you can maintain your safe driving by collecting “STREAKS”. ‘Streak’? Apa tu? ...

🚗 Malaysia Roadtax Price List (2023 UPDATED)

(Updated for Year 2023 Malaysian Car Roadtax) – Updated September 2022: Perodua Ativa, Hyundai Ioniq EV, Kona EV Roadtax, KIA EV6 Is it the time to renew your vehicle roadtax...

DriveMark didik sikap pemandu

TAHUKAH anda Malaysia berada di kedudukan ke-16 di dunia yang melibatkan statistik tertinggi kemalangan jalan raya? Statistik itu juga amat membimbangkan, namun masih ada peluang untuk mengubah senario tersebut. Pixelated...

☎️ Emergency Hotline Contact Number of Malaysian Insurers

For every Malaysian vehicle owner, they must make sure that their vehicle is covered under an insurance company. It is known as Motor Comprehensive Insurance, which protects your vehicle against...

Nak menang petrol voucher RM100? Jadilah 7 pemandu terbaik app DriveMark®

DRIVEMARK HERO CHALLENGE #3 Contest Period: 16-30 November 2017 [...]Read More...