For every Malaysian vehicle owner, they must make sure that their vehicle is covered under an insurance company. It is known as Motor Comprehensive Insurance, which protects your vehicle against liabilities to other parties for death or bodily injuries, damages to other parties’ properties, accidental or fire damages to your car, and theft of your car.

This type of protection also provides road assistance services such as:

- 🛠️ Breakdown Assistance

- 🧰 Battery Delivery Service

- 🚚 Towing Assistance

- 🤝 Alternative Travel Assistance

- 🚑 Emergency Evacuation Assistance

You are encouraged to check with your insurance company on what road assistance services do they offer . Road assistance services offered by every insurance company may differ from one another.

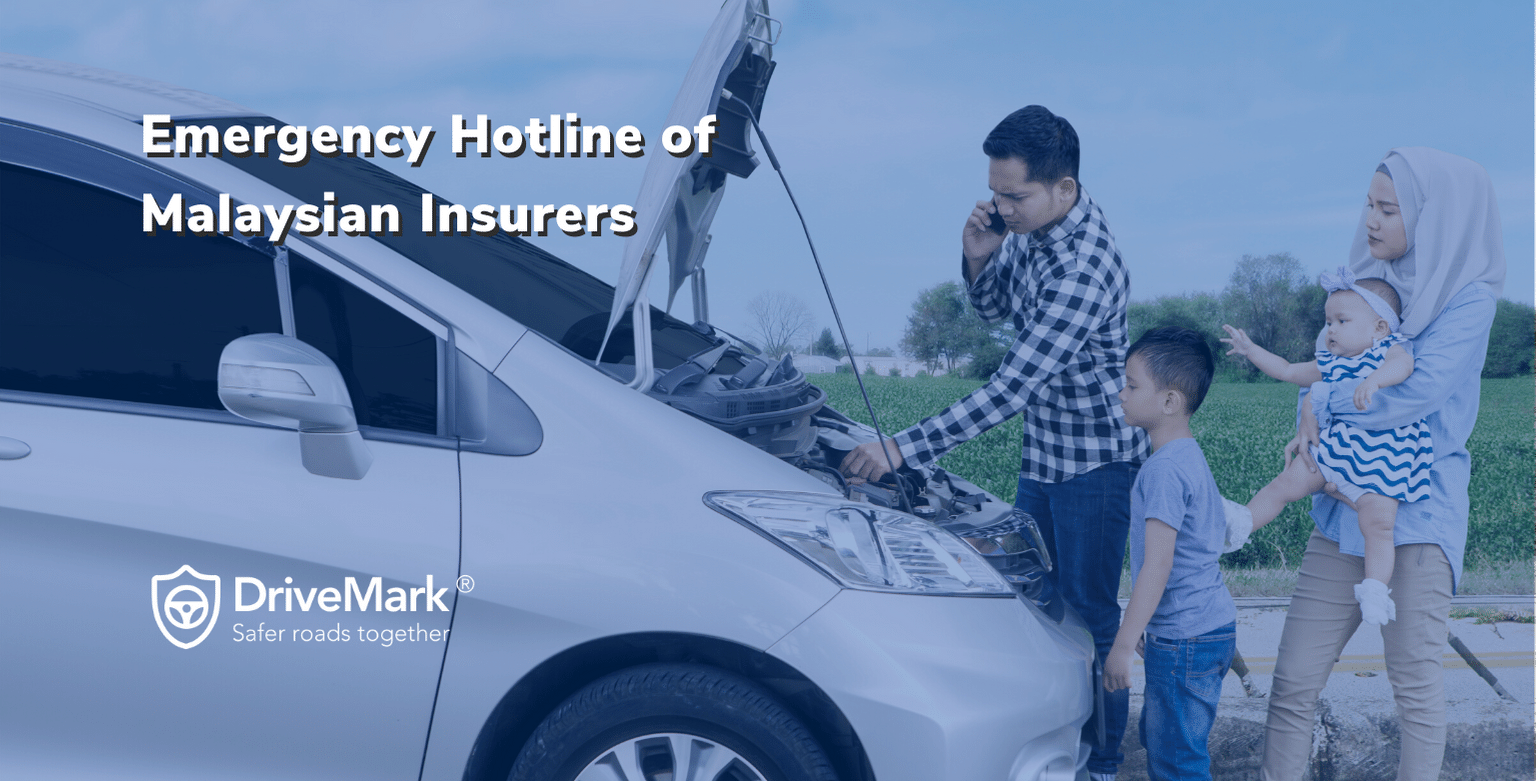

Emergency Hotline of Malaysian Insurance Companies ☎️

This is a list of emergency hotline contact numbers of all the insurance company in Malaysia. These contact numbers are specifically meant for road assistance services.

| Insurance Company | Emergency Hotline |

|---|---|

| AIA General Berhad | 1800-88-8733 |

| AIG Malaysia Insurance Berhad | 1800 88 8811 |

| AXA Affin General Insurance Berhad | 1800-88-1033 |

| Allianz General Insurance Company (Malaysia) Berhad | 1800-22-5542 |

| AmGeneral Insurance Berhad | 1300-80-3030 |

| Berjaya Sompo Insurance Berhad | 1800-889-933 |

| Chubb Insurance Malaysia Berhad | 1300-88-0128 |

| Etiqa General Insurance Berhad | 1800-88-6491 |

| Great Eastern General Insurance (Malaysia) Berhad | 1300-1300 88 |

| Liberty Insurance Berhad | 1800-88-5005 |

| Lonpac Insurance Berhad | 1300-88-1138 |

| MPI Generali Insurans Berhad | 1800-22-2262 |

| MSIG Insurance (Malaysia) Bhd | 1300-880-833 |

| Pacific & Orient Insurance Co. Berhad | 1800-88-2121 |

| Pacific Insurance Berhad | 1800-88-4488 |

| Progressive Insurance Berhad | 1300-881-238 |

| QBE Insurance (Malaysia) Berhad | 1300-88-4847 |

| RHB Insurance Berhad | 03-9206 8118 |

| Tokio Marine Insurance (Malaysia) Berhad | 1800-88-0812 |

| Tune Insurance Malaysia Berhad | 1800-88-5753 |

| Zurich General Insurance Malaysia Berhad | 1300-88-6222 |

Be careful of road scammers! 🙅

If you find yourself stranded on the side of the road with your car, please contact your insurance company immediately for assistance.

There is a chance that a random tow truck will suddenly appear and offer their services. Do not accept their offer as you could potentially end up having to pay more than you actually should.

These tow truck scams are sadly a common occurrence on Malaysian roads. They would go as far as holding your car against your will until you pay a ridiculous fee. Click here to read more about these road scams and tips on how to avoid them.

What should I do after a car accident? 💥

The first thing that every driver should after a car accident is to stay calm and avoid engaging in an argument with other driver(s) involved. Next is to document the accident as it could help support evidence to how the accident occurred. You should also make sure to exchange details with the other driver(s).

If there are witnesses of the accident that you are involved, you should consider getting their details as well. Afterwards, you and the other driver should head down to the nearest police station to lodge a police report. Lastly, you should contact your insurance company to notify them of the accident and consult them on what you should do next.

If you don’t know which number to call, feel free to refer to our list of emergency hotline contact numbers of Malaysian insurers as above. We also have a dedicated post filled with important details on what you should do after an accident. Click here to read more about 7 important car accident tips that you should know.

–

If you think these tips are helpful, we hope you could share this article with you family & friends. It might just help them their time of need. 🤗💖

Similar Articles

Car Accident Detection and Emergency Alert using DriveMark mobile app

When DriveMark was launched back in 2017, it carried our aspiration to make the roads safer for everyone. From then on, we introduced several features to encourage drivers to be...

Kuiz ‘Child Seat’ Untuk Parents!

[playbuzz-item wp-pb-id=”144442″ item=”9ec0e640-43c6-4d0c-a685-7b149e440171″ info=”false” shares=”false” comments=”false” recommend=”undefined”] Jangan lupa untuk kongsi dan tag rakan-rakan anda kuiz ini berserta hastag #drivesaferlah. 50 individu bertuah bakal memenangi voucher RM30 petrol. [...]Read More...

Petronas launches Coffee Break campaign for Chinese New Year, introduces National Safest Driver Challenge

Written by Jonathan Lee for PaulTan, 1st February 2019 With many starting to head home for their annual Chinese New Year celebrations, Petronas has launched its annual Coffee Break safety...

Senarai Harga Roadtax Perodua Myvi (List Lengkap sejak 2005-2021)

Perodua Myvi merupakan satu model yang paling laris terjual di Malaysia. Dari tahun 2006 sehingga 2013, jualan Myvi adalah paling top mengalahkan semua jenama dan model kereta yang lain. Model...

Temui DriveMark di Kuala Lumpur Run 2017

Drivemark telah berkolaborasi dengan Hausboom semasa Kuala Lumpur Run 2017 yang diadakan pada hari Ahad, 13 Ogos 2017. Para peserta bersama pingat yang dimenangi. Team Drivemark mempromosikan app Drivemark yang...

7 Important Car Accident Tips That You Should Know 🤕

Road accidents are almost always unexpected and could happen to anyone, even safe drivers. Since we spend most of our time on the road, we should be aware of car...