Written by Danial Dzulkifly for the MalayMail, 2nd February 2019

SERDANG, Feb 1 — After suggesting last week that no more discounts would be given for traffic fines, Transport Minister Anthony Loke today maintained that the “carrot and stick” method remains an effective way to educate drivers on road safety.

Loke gave a clear distinction between his “carrot and stick” approach, pointing out that there should not be any compromise for traffic offences.

“We believe we cannot only use the stick but the carrot as well to entice people (on road safety),” he said at the launch of Petronas Dagangan Berhad’s (PDB) annual Coffee Break road safety campaign at the Petronas Solaris Putra station here.

“Of course, in the last few days, the focus was on my stance to not give discounts on (traffic) summonses. Of course, some people are happy, some used that to whack me, and even the former prime minister has given attention to that.

“But when we talk about carrot and stick, our message must be very clear to the public that if you don’t follow road rules and regulations, you will be penalised,” he said.

Another initiative that Loke intends to implement is rewarding disciplined drivers with discounted vehicle insurance.

He said he has talked to the Malaysian Automotive Insurance Association (PIAM) and is currently waiting for their input on the matter.

“We are waiting for them to come out with the mechanism on how to give the incentives and discounts to premium holders who do not have any outstanding summons with the authorities.

“We hope that we can at least roll this mechanism out by this year,” he said.

Loke also revealed that in 2017, there were 6,740 road fatalities recorded, whereas in 2018, only 6,284 fatalities were recorded.

Despite the reduction, Loke said the ministry is constantly looking at ways to reduce traffic-related deaths.

To promote better road safety during Chinese New Year, PDB’s campaign was launched alongside the National Safest Driver Challenge carried out in collaboration with PLUS Highway, Touch ‘n’ Go and Katsana, a company that manages GPS tracking and fleet management systems.

The Challenge is conducted via DriveMark, a safety mobile application which keeps track of driving behaviour and rewards safe driving actions with positive scores and vice-versa.

Winners of the challenge stand a chance to win two grand prizes of 100,000 Mesra points (equivalent to RM1,000), RM1,000 Touch ‘n Go credit, 10,000 PLUSMiles points and RM10,000 DriveMark Personal Accident Coverage for 12 months.

Loke said such advocacy campaigns are also needed from the private sector to help promote better road safety practices.

Similar Articles

Car Accident Detection and Emergency Alert using DriveMark mobile app

When DriveMark was launched back in 2017, it carried our aspiration to make the roads safer for everyone. From then on, we introduced several features to encourage drivers to be...

KATSANA signs MoU to drive forward Usage-based Insurance

KUALA LUMPUR: Usage-based Insurance (UBI) is a platform that is no longer foreign in this “Internet of Things” (IoT) world. However, not many in Malaysia are familiar with this mechanism...

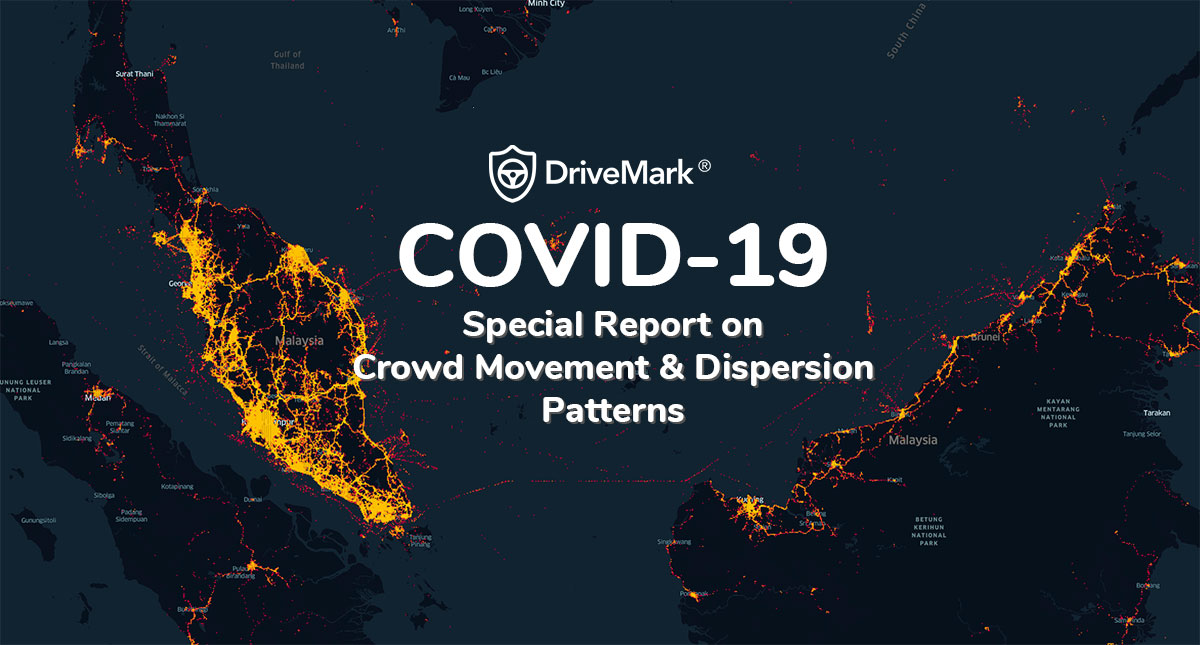

Crowd movement pattern during Covid19 crisis

During this period of Restricted Movement Order, DriveMark has a unique opportunity to understand how well Malaysians comply to the #StayAtHome directive. You see, DriveMark is app that collects driver...

Miros Memeterai Perjanjian Persefahaman Dengan 13 Rakan Strategik Dalam Meningkatkan Usaha Keselamatan Jalan Raya Di Malaysia, Indonesia Dan India

KENYATAAN MEDIA _____________________________________________________________________________ BANDAR BARU BANGI, 11 OGOS 2020 – Peningkatan tahap keselamatan jalan raya di Malaysia merupakan salah satu agenda utama Institut Penyelidikan Keselamatan Jalan Raya Malaysia (MIROS) yang...

DriveMark September Hero

Bernard Henry What does it take to be a super hero? Does a super hero must be a vigilan-teh who wears all black, has a loyal butler and want to...

Senarai Harga Windscreen/Cermin Kereta Malaysia (2023 TERBARU)

(Dikemaskinikan bagi Tahun 2023) Terima kasih kerana menggunakan website ini – September 2022: Tambahan cermin kereta Tesla, Maserati, Aston Martin, Citroen, Range-Rover, model BMW terkini, Bentley, model Porsche, Lexus Insurans...