With the release of the much awaited DriveMark version 2.0 last week, we saw thousands of new users within such a short period of time. That many users exposed us to numerous compatibility issues, mostly due to a plethora of...

Development

The history behind DriveMark mobile telematics app

“Asians Cant Drive” Do you know that Malaysia has one of the highest road fatalities in the world? For every 100,000 citizens, 24 Malaysians are killed on the road. In comparison to our southern neighbour, Singapore has only 4 fatalities...

Challenge, Challenge Highlights, Keselamatan Jalan Raya

Petronas CoffeeBreak Winner Leaderboard!

Hello DriveMark Heroes! Last Raya we had an awesome run at the Petronas Coffee Break Challenge. Together, we’ve collected up to 1.2 Million kilometres on DriveMark for the Challenge! Hooray! And we have the names of the winners! If you...

Keselamatan Jalan Raya, Media Massa, Partnership Highlights

Travel Safe with Petronas Coffee Break This Hari Raya

Complimentary Coffee, Snacks and DriveMark App to Help You Stay Safe Kuala Lumpur, 11 June 2018 – The PETRONAS Coffee Break campaign returns once again in conjunction with the upcoming Hari Raya celebration, to encourage motorists to take regular breaks...

Challenge

Nak menang petrol voucher RM100? Jadilah 7 pemandu terbaik app DriveMark®

DRIVEMARK HERO CHALLENGE #3 Contest Period: 16-30 November 2017 [...]Read More...

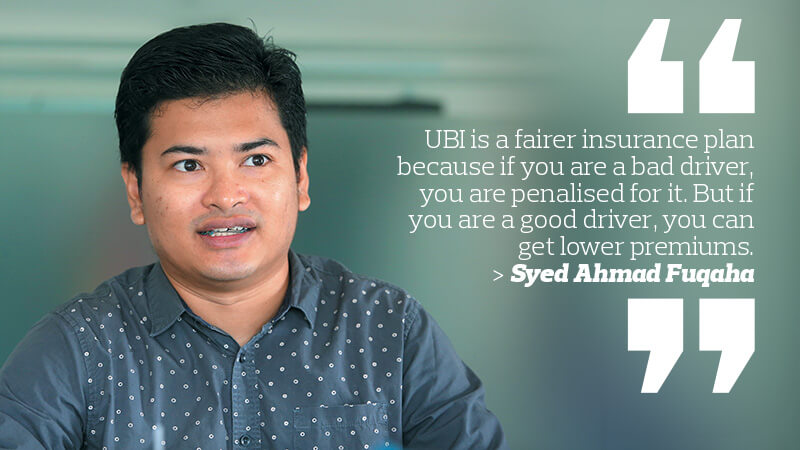

Usage-based Insurance

Insurance: A fairer way to price motor insurance premiums

This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on September 11, 2017 – September 17, 2017. Written by Tan Zahi Yun, 20 September 2017 The second phase of the liberalisation of motor insurance, which kicked off on...

Partnership Highlights

KATSANA Offering Big Prizes at the Malaysia Autoshow 2017

It’s common knowledge that theft is becoming increasingly common in Malaysia, but few know just how common that truly is. For instance, did you know that 1 car is stolen every 24 minutes? With that in mind, Katsana came up...

Bahasa Melayu, Tips Kereta

Fresh Grad & Kereta Baru, amboi, amboi…

Kalau duduk rumah sewa, tapi pakai kereta mewah, amboi, amboi.. Itulah ayat tipikal generasi milenia kita yang kurang skill ukur baju di badan sendiri. Tapi to be honest, maybe bukan kerana tak ukur, tapi salah ukur. Kebanyakkan first time car...

Aktiviti Umum, Challenge, Media Massa, Usage-based Insurance, Winner Highlights

Pemenang DriveMark Challenge 1 semasa JomLaunch 2017!

JomLaunch merupakan platform untuk ahli komuniti JomWeb melancarkan sebarang produk yang melibatkan IT. Ianya bertujuan bagi membantu projek-projek komuniti, sumber terbuka, projek persendirian mahupun komersil dapat diketengahkan. [...]Read More...

Aktiviti Umum, Bahasa Melayu, Usage-based Insurance

Sukan SEA – Semi Final Bola Malaysia vs Indonesia

Sekitar perlawanan bola sepak semasa Sukan SEA antara Malaysia dan Indonesia pada 26 Ogos 2017. [...]Read More...

Partnership Highlights

KATSANA signs MoU to drive forward Usage-based Insurance

KUALA LUMPUR: Usage-based Insurance (UBI) is a platform that is no longer foreign in this “Internet of Things” (IoT) world. However, not many in Malaysia are familiar with this mechanism to give value to vehicle insurance, which helps to create...

Bahasa Melayu, Keselamatan Jalan Raya, Media Massa, Partnership Highlights, Usage-based Insurance

Sekitar MoU antara KATSANA, Allianz Malaysia, Etiqa Insurance & Takaful & Axiata

Pixelated Sdn Bhd (“KATSANA”) telah menandatangani dua perjanjian persefahaman bersama Allianz Malaysia Berhad, Etiqa Insurance Berhad, Etiqa Takaful Berhad dan Axiata Business Services Sdn Bhd. Perjanjian persefahaman ini bertujuan untuk bersepakat dalam menaikkan penggunaan usage-based insurance di Malaysia. Berikut adalah...

Partnership Highlights

Katsana signs MoU with Allianz, Etiqa and Axiata to develop usage-based motor insurance, DriveMark app

The motor insurance sector entered into the new era of phased liberalisation in July, with full detariffication scheduled to take place in 2019. It’s now a free market, and vehicle insurance premiums are now no longer calculated on a fixed...